Introduction to the Financial Planning Pyramid

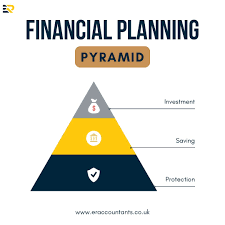

In today’s complex financial landscape, having a clear and structured approach to managing your money is essential. One of the most effective tools to understand and implement comprehensive money management strategies is the financial planning pyramid. This visual model breaks down financial priorities into hierarchical levels, making it easier to focus on what matters most at each stage of your financial journey. Whether you’re just starting out or looking to solidify your wealth-building plan, the financial planning pyramid can serve as a valuable guide to build security, grow wealth, and ensure long-term stability.

The pyramid structure is not just a visual metaphor—it represents the logical order in which financial decisions should be made. Starting with a solid base, each level builds upon the previous one, ensuring that individuals create a well-rounded, secure, and growth-oriented financial plan. In this article, we’ll explore each layer of the financial planning pyramid in detail, providing practical steps to help you make smarter financial choices and build lasting wealth.

Foundation Layer: Financial Stability Essentials

At the base of the financial planning pyramid lies the foundation of financial stability. This is the most critical layer because it supports everything above it. Without a stable financial base, it becomes increasingly difficult—and risky—to pursue investments, long-term savings, or legacy planning.

The first step in this foundational layer is budgeting. A realistic, well-structured budget helps you track where your money goes, control unnecessary expenses, and allocate funds toward your financial goals. This means identifying all income sources, listing out fixed and variable expenses, and monitoring your spending habits on a regular basis. Tools like budgeting apps or simple spreadsheets can make this task more manageable.

Next comes building an emergency fund. Life is unpredictable—medical emergencies, job loss, or major repairs can strike without warning. An emergency fund provides a financial cushion, ideally covering 3 to 6 months of living expenses. This fund should be easily accessible, preferably in a high-yield savings account, and should not be touched unless it’s a real emergency.

Finally, insurance is a crucial part of this foundation. It protects you and your family from financial devastation caused by unforeseen events. Health insurance, life insurance, property insurance, and disability insurance are all vital to ensure you’re not financially ruined by unexpected life events. This layer of protection is key before progressing to more complex financial moves.

Protection Layer: Managing Risk and Reducing Debt

Once the foundation is secured, the next step in the financial planning pyramid focuses on risk management and debt control. While it may be tempting to jump directly into investments, ignoring the financial risks and high-interest debts can derail even the most promising plans.

Debt management begins with distinguishing between good debt (such as mortgages or student loans) and bad debt (like credit card balances or payday loans). Prioritize paying down high-interest debt aggressively using strategies like the snowball or avalanche method. The goal is to reduce financial liabilities that eat into your cash flow and hinder your ability to save or invest.

Simultaneously, it’s important to manage financial risks through proper planning. This includes reviewing your insurance coverage to ensure it aligns with your current life circumstances. As life evolves—getting married, having children, or buying a home—your insurance needs change, and your financial plan should adapt accordingly.

This layer is about reducing exposure to financial threats and ensuring that you’re not just earning money but also protecting what you already have.

Growth Layer: Investing for the Future

With risk under control and debts managed, the next logical step is to grow your wealth. This is where you begin to look toward the future and make investments that can yield long-term benefits. This level of the financial planning pyramid focuses on strategic investing and long-term savings.

Start by defining your financial goals—do you want to retire early, buy a second home, or fund your child’s education? Clear goals guide your investment decisions. Next, determine your risk tolerance, which is your ability and willingness to endure market fluctuations. Young investors can typically afford to take more risks, while those closer to retirement might lean toward more stable investments.

Basic investment vehicles include stocks, bonds, mutual funds, and ETFs. Stocks offer higher potential returns but come with more risk. Bonds and fixed-income investments are safer but yield lower returns. Diversification is key—spread your money across various asset classes to minimize risk.

Retirement planning should be a major focus at this stage. Contribute regularly to retirement accounts like a 401(k), Roth IRA, or traditional IRA. Take advantage of employer matches where available, and aim to increase your contributions annually. The earlier you start, the more compound interest works in your favor.

Optimization Layer: Tax Efficiency and Wealth Accumulation

With investments underway, the next layer focuses on optimizing your wealth through tax strategies and targeted savings plans. This step often gets overlooked but can significantly boost your net returns over time.

Tax planning is not about evading taxes but rather minimizing them legally. Utilize tax-advantaged accounts, such as Health Savings Accounts (HSAs) or 529 college savings plans. Consider how long you hold investments to qualify for favorable long-term capital gains tax rates. Be mindful of how dividends, interest, and capital gains impact your tax liability.

This is also the time to save for significant life events—like children’s education, weddings, or large purchases. Setting up targeted savings accounts for each goal helps you stay focused and measure progress. Automating contributions to these accounts ensures consistency and discipline in reaching your financial objectives.

By efficiently managing your investments and tax strategy, this layer helps you keep more of what you earn and grow your wealth faster.

Legacy Layer: Estate Planning and Wealth Transfer

At the top of the financial planning pyramid lies estate planning and legacy building. While it may seem like a distant concern, proper estate planning ensures that your hard-earned wealth is passed on according to your wishes.

Start by drafting a will that outlines how your assets should be distributed. Without a will, state laws determine how your property is handled, which may not align with your intentions. In more complex cases, trusts can help manage and protect your estate, particularly if you have minor children, significant assets, or specific instructions on asset distribution.

Designate a power of attorney and create advance healthcare directives to ensure that your medical and financial decisions are respected if you become incapacitated. These documents give trusted individuals the authority to act on your behalf.

If philanthropy is important to you, charitable giving strategies—like donor-advised funds—can align your legacy with your values while offering tax benefits.

This final layer ensures that the wealth you’ve built continues to serve your loved ones and causes you care about long after you’re gone.

Adapting the Financial Pyramid to Your Life

While the financial planning pyramid offers a structured model, it’s essential to adapt it based on your age, income, goals, and life stage. A 25-year-old just starting a career will have different priorities than a 55-year-old approaching retirement. Regularly review and adjust your financial strategy to reflect life changes such as marriage, childbirth, job transitions, or inheritances.

Today, many people also leverage technology to enhance financial planning. Mobile apps, robo-advisors, and budgeting tools can simplify tracking, investing, and managing your money. These tools make financial planning more accessible than ever before.

Mistakes to Avoid When Using the Financial Planning Pyramid

While the financial planning pyramid is a reliable framework, certain pitfalls can hinder your success. One of the biggest mistakes is skipping foundational steps, like budgeting or insurance, in favor of higher-risk investments. Without a solid base, your entire financial strategy can crumble under unexpected pressure.

Another common error is underestimating the importance of risk management. Lack of adequate insurance or improper debt handling can lead to serious setbacks. Also, many people fail to update their financial plans as their lives evolve, which can render the pyramid ineffective over time.

Staying consistent, disciplined, and proactive is key to avoiding these missteps and achieving your financial goals.

Conclusion: Building a Strong Financial Future, One Layer at a Time

The financial planning pyramid is more than just a visual tool—it’s a powerful strategy that can help you build a secure, prosperous financial future. By following a step-by-step approach, starting from foundational budgeting and protection to investment, tax planning, and legacy building, you can achieve greater financial clarity and confidence.

No matter your age or financial situation, it’s never too early—or too late—to start planning. Evaluate where you currently stand in the pyramid and take deliberate actions to move upward. And if needed, don’t hesitate to seek guidance from financial professionals who can help you make informed decisions every step of the way.

By understanding and applying the principles of the financial planning pyramid, you’re not just managing money—you’re building a future rooted in security, growth, and purpose.

Do Read: iZoneMedia360.com – The Future of Digital Marketing Solutions