Operating Cash Flow

There are three basic methods to calculate operating cash flow. These are the direct method, the free cash flow method, and the indirect method. The first method involves using a cash flow statement. Then, you can use that cash flow statement to determine how much cash your company has available to meet its current obligations. Depending on the size of your business, you may need to add up different components of operating cash flow to get a more accurate calculation.

Calculating operating cash flow

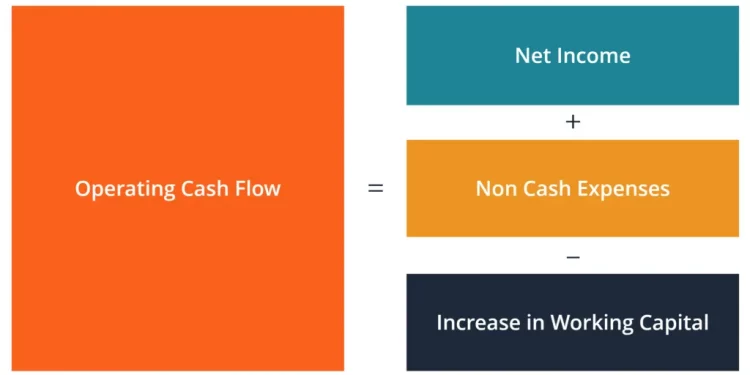

There are two ways to calculate operating cash flow for your business. You can use the indirect method or the direct method, depending on which one you prefer. The indirect method starts with net income and adds back expenses like depreciation, stock-based compensation, and deferred taxes. Next, subtract the changes in working capital like increases in accounts receivable and inventory. The final figure will be the cash available for operating activities. Calculating operating cash flow for your business can help you plan for the future and ensure the sustainability of your business.

In addition to helping you understand your company’s overall financial health, operating cash flow can also help you decide whether you should invest in the company or not. In other words, it tells you whether the business will remain afloat or need to borrow money to meet its current liabilities. A higher operating cash flow ratio is a good sign for a company with higher profits and lower expenses. However, the cash flow ratio for a company with lower expenses tends to be lower than for a restaurant or e-commerce business with high margins.

Operating cash flow is the remaining amount of cash available for your business after all expenses are paid. However, it does not include interest or dividends that you have received in the last year. In fact, it is a measure of your overall liquidity, and it will help you allocate your resources to the most productive activities. To calculate operating cash flow, you can use the accounting software of your company. It will also require information on other financial metrics, such as the ratio of longterm capital expenditures to operating cash flow.

If you have access to a company’s accounts receivable and payable figures, you can perform an indirect method instead. This method is easier to understand and has the advantage of a more detailed report. If you prefer the direct method, you’ll need to make sure that your company’s revenues and operating expenses match. The indirect method is the more detailed way to calculate operating cash flow. It requires a balance sheet and an income statement, so you should compare both methods and choose one that meets your needs.

In short, you’ll want to subtract operating expenses from operating revenue. Then, you’ll have free cash flow. This is the amount of cash available for the business to distribute to shareholders before debt payments, dividends, and share repurchases. Free cash flow is also a useful liquidity metric for investors and banks alike. A company’s operating cash flow is an indication of the true profitability of a business.

Operating cash flow is a crucial benchmark to measure the success of core business activities. It shows whether the company can generate a positive cash flow during regular business activities. If it cannot, it may need external financing in order to invest in capital expansion. Once you have calculated operating cash flow, you can set goals for growth and stability. So, what are the benefits of calculating operating cash flow? You’ll be amazed how much more informed you’ll be able to make a better decision.

Free cash flow

There are a number of different ways to calculate free cash flow. These range from different approaches depending on the audience and company, but the simplest is to subtract capital expenditure from operating cash flow. This method is usually used for non-financial companies that have clearly defined capital expenditures. However, it is possible to use any method of calculation. Listed below are some examples of how free cash flow is calculated. If you’re interested in a particular method, you can read more about the methodology on Wikipedia.

In some cases, a company’s free cash flow may appear to be higher than its actual profitability. This can happen when the business is taking on debt or when it is investing in new products and services. However, it does not necessarily mean that the company is failing. In fact, even healthy companies can experience a dip in free cash flow during a period of growth. These corporate moves, such as acquisitions, may temporarily reduce free cash flow. However, older companies are generally more stable and have more stable free cash flow than startups. While free cash flow may not be a definitive indicator of a company’s profitability, it is a helpful tool to assess how your business is performing in its daily operations.

There are several factors that can influence a company’s free cash flow. One of these factors is the maturity of the firm. A mature firm does not need to invest a lot of capital in growth. Therefore, the ratio of free cash flow to operating cash flow is higher in mature companies than in young companies. Therefore, it is important to evaluate your company’s free cash flow to understand how it is able to meet its growth objectives.

When calculating free money flow, you must first determine the amount of cash from operations you have available to invest. Your operating cash flow should be equal to net income, minus non-cash expenses, such as accounts payable and inventory. Non-cash current assets may also be excluded, depending on the status quo and investments. For instance, increasing net working capital may result in a decrease in free cash flow. If the growth of your company is negative, it may reduce your company’s working capital.

The concept of free cash flow from operating cash flow can be applied to any type of business. It is the amount of money generated by the business’s normal operations, minus the costs associated with generating that revenue. This figure will be found in your balance sheet and income statement. You must subtract the costs from these expenses, such as taxes and the required investments in operating capital. In some cases, you’ll also need to take the company’s net income into consideration, which can be a very important metric for evaluating a company’s ability to repay the loan.

Indirect method

The indirect method of operating cash flow refers to the process of estimating the total amount of operating cash for a period by going from an accrual accounting system to a cash accounting system. Using this method, cash inflows and outflows can be accurately depicted in a balance sheet. As an example, a customer uses $100 of credit to make a purchase, which is listed as a debit in accounts receivable. The credit amount is also added to the company’s revenue, and the total is shown on the balance sheet.

The indirect method of operating cash flow is also known as the ‘cash-flow’ method. The indirect method of operating cash flow begins with net income and modifies it with non-cash revenue and expense items to obtain a statement of operating cash flow. This method uses a standard format and links it to the company’s income statement and comparative balance sheet. Using this method will help you understand the business’ cash flow better and make sound decisions in the future.

The direct method is more time-consuming than the indirect one, and requires that you review all receipts and payments made by your company. The time it takes to do this will vary depending on the size and nature of your business. For example, if you are running a retail business, you may need to do this more often than a wholesale business or a manufacturing company. This method is labour-intensive and expensive, and it can also create a transparency issue. Financial details can be made public and used against your business.

The indirect method differs from the direct method in that it treats non-cash expenses differently. This method starts with net income and subtracts non-cash items like depreciation from net income. It also includes changes in the connector accounts. The difference between the two methods is in the way the amounts are recalculated. The indirect method is often used to calculate the total amount of operating cash in a year.

Operating cash flow is a critical measure for investors and lenders. It allows you to determine whether a company can afford to pay dividends or add more debt. As a result, it is imperative to understand how to determine operating cash flows using either the direct or indirect method. You can find more information about operating cash flow in the CFA Institute’s Ultimate Cash Flow Guide. This resource will help you determine which method is right for your business.

The indirect method of operating cash flow uses a balance sheet with both an asset and liability account. The first line will reflect net income, with the remaining lines showing liability and asset accounts. The second line will reflect any additional payments made to employees. This method is usually less accurate because the liabilities are more complicated than the assets. So, the indirect method is the more accurate way to calculate the cash flow of a business. The indirect method of operating cash flow provides you with a more accurate picture of cash flows in a given period.