If you’re interested in following the latest news from the stock market, it’s helpful to follow SPY, the largest ETF tracking the S&P 500 Index. This fund spreads your investment dollars across 11 sectors and requires little human intervention. SPY has a large following on StockTwits. We’ll look at its performance and how you can follow it. But first, let’s look at how it’s made money in recent years.

SPY is the biggest ETF tracking the S&P 500 Index

An exchange-traded fund (ETF) tracks the performance of the S&P 500 Index, which is a broad gauge of the health of the U.S. stock market. Since SPY comprises many stores, giant gains and losses have little impact on SPY’s overall performance since it consists of 500 large-cap stocks.

The SPDR S&P 500 ETF (SPY) is a popular way to invest in the U.S. economy. It has a meager expense ratio of only 0.09%, equivalent to fund management fees. Therefore, an investor investing $100,000 will only have to pay about $90 in management fees. They trade the SPY on the New York Stock Exchange under the symbol SPY. It is also a relatively low-cost option that can be a good fit for investors seeking to invest in the U.S. economy.

The S&P 500 is a popular benchmark for retail investors and professional fund managers. Its popularity has led to numerous exchange-traded funds (ETFs) that track the S&P 500. These ETFs track the S&P 500 Index and attract trillions of assets under management. Founder John Bogle created the first exchange-traded fund, which became the largest ETF tracking the S&P 500 Index.

The SPDR S&P 500 ETF is one of the oldest and largest ETFs. It allows investors to simultaneously invest in all of the S&P 500’s stocks. It is an appealing offering, and investors hold more than $340 billion. State Street, a financial services company, sponsors the fund, and Regarding the S&P 500 Index, SPY stock is a great choice.

It spreads investment dollars across 11 sectors.

SPY is an exchange-traded fund that’s been around since 1993. The fund traded for almost a million shares on its first trading day. Its assets far exceeded its early expectations. AMEX executives Jay Baker and Ivers Riley were skeptical about the fund but ultimately challenged them to attract trading. Finally, they came up with a guide for wholesalers to SPY.

Stocks like SPY expose investors to all 11 sectors of the economy, but you can also invest in specific sectors. You can select ETFs that track particular sectors, such as healthcare and technology. In short, SPY stocks spread your investment dollars across 11 industries to give the best stocks a higher percentage of weight. The SPY stock’s performance in recent months has led it to be the most valuable sector, with more than a quarter of its value allocated to technology stocks. Another 13% goes to health care stocks.

The ETF market started slowly. Initially, the market only issued a few baskets. That’s when They developed a company such as SPY. Today, it’s common for investors to invest in a basket. With this investment option, investors can diversify their portfolios by buying a basket of stocks. Despite this volatility, the SPY has earned solid returns over the past two decades.

When SPY first came to market, the company wasn’t widely known to investors. Most brokerage firms didn’t recommend SPY to their customers. Because the unit investment trust was new, it was more expensive than its competitors. However, strong backing from State Street helped the product move from “Hail Mary” to serious consideration. Offering custody of securities in a unit investment trust was relatively easy. After all, U.S. securities exchanges already handled closed-end funds, structured notes, options, and cash-settled commodity futures. The index-based unit investment trust consolidated several trading strategies into one convenient investment vehicle.

It relies less on human intervention than other investors.

The S&P 500 is a more rules-based index relying less on human intervention. Humans select the stocks that make up the index, but SPY does not. It owns nearly all large U.S. stocks and is the most popular ETF, with more than $3 trillion in investor assets. You should know how these indexes work if you’re considering investing in ETFs.

It has a large following on StockTwits.

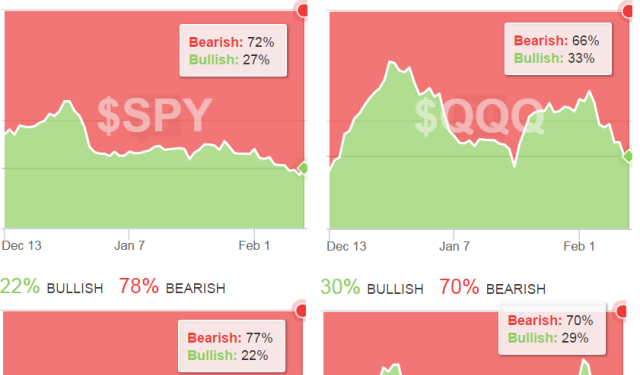

You’ve probably heard of StockTwits, the popular website where traders share their opinions on stocks and other financial instruments. You can also follow the company’s official Facebook page for updates on its latest news, market trends, and fun updates. More than 37,000 people follow the company’s Facebook page. The company claims to have a six-million-member community and a monthly average of one million users.

While many investors swear by StockTwits, the platform is not regulated. Users must evaluate the information they are reading before acting on it. Trading on StockTwits’ forum is challenging because traders have to wade through conflicting information. Even those with access to the data are not immune to mistakes.

While risks are associated with trading high-motion stocks, these stocks generally offer rapid gains. This strategy is best suited for those familiar with market trends and patterns. The store with the most social volume is usually experiencing a meaningful move, and their tweets will often reflect that trend. It is a great way to make money on the stock market without losing your shirt. So how does StockTwits work?

The Earnings Calendar on StockTwits helps investors keep track of earnings. Notifying users of upcoming earnings also provides a snapshot of previous payments. It allows investors to plan their trading activity. For day traders, this is a vital tool. As with any other online community, StockTwits faces the risk of spamming and abuse. The community has strict rules and limits that you must follow to avoid violating these rules.