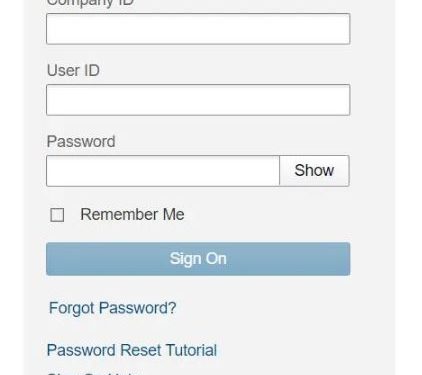

Wells Fargo Login

Visiting Wells Fargo’s website is easy, but how do you log in? You will need your user id and password to sign in to your online account, account number, and date of birth. To get started, follow the steps below. Get started today if you haven’t yet signed up for an account with Wells Fargo! It’s free and convenient to start banking online today! There’s even an app for that!

Wells Fargo Online

You must create an account to log in to Wells Fargo online banking. You will need to enter your email address, password, and username. After that, you must confirm your identity by providing your social security or taxpayer identification number. Contact Wells Fargo customer service if you’re unsure what these numbers are. They will help you set up your account. You can use these numbers to access your account online, and they also offer online customer support.

Once you have registered for an account, you can access your Wells Fargo Online banking and manage your finances in no time. It is important to remember that your account number and password should be at least six to fourteen characters long and must contain at least one character. You cannot use the same number or letter more than three times consecutively. You must use different passwords for each account if you have more than one bank account. Also, you can create unique user names for each bank account.

There are many benefits to using Wells Fargo online. The company’s branches are open six days a week and closed only on public holidays. In addition to their branch network, they’re also active on social media. Follow them on Twitter or Facebook to stay up-to-date with their latest news. You can also log into your account from anywhere. So if you’re looking for an online banking option, consider using Wells Fargo. You’ll be glad you did. This is your one-stop shop for financial security.

Fingerprint sign-on is available for specific devices. While your fingerprints may be stored on your device, they will be available to additional people. Fingerprint sign-on may be subject to mobile carriers’ messaging and data charges. The Wells Fargo Mobile app for Online Banking may also be suitable. This gives you 24-hour access to your online banking account from any location. For more information, refer to your Wells Fargo Online Access Agreement.

If you use Wells Fargo Business Online, you may want to enroll in Zelle. This service is very convenient for sending money to trusted individuals. You can send money directly to friends and family by requesting an email. The email address must be verified before Zelle can be used. While you can send money to a friend using Zelle, this service is best for sending money to people you know and trust. It doesn’t come with a protection program for payments made without authorization. Using Zelle, it would be best if you also enrolled through your financial institution.

Wells Fargo Alerts help you avoid overdrafts and late fees. You can receive text messages, push notifications, or email alerts to be notified of activity on your account. You can opt for Wells Fargo Online alerts depending on your security needs. These alerts notify you of changes to your account and even alert you to potentially fraudulent activities. This way, you will know about these changes and can take action accordingly.

Wells Fargo Business Online

You can easily manage your finances online with an account with Wells Fargo. This service offers a variety of features to help you manage your business. Wells Fargo has more branches than any other bank in the U.S., and you can even use Wells Fargo ATMs for free. The bank has over 12,000 locations across the country, but you will need to pay a fee to use any ATMs other than Wells Fargo.

If you have an account with other financial institutions, you can set up automatic payments for them from your Wells Fargo account. This service is free and can help you manage your business finances online. The payment process is fast and easy, and you can even add new payees without leaving the site. You can also manage your account using your business card in Wells Fargo Business Online. You’ll find all the information you need right there, including the balances, fees, and more.

You can use Wells Fargo Mobile to manage your accounts for mobile devices. You only need your Wells Fargo Business Online username and password to access your Wells Fidelity Business Online account. Also, You can log in using a computer or mobile browser to access Wells Fargo Business Online. Once you’re logged in, you can manage your account online from anywhere. You can even use the mobile app to manage your bills if you’re on the go.

A business checking account is free to open if you’re a customer of Wells Fargo. However, the requirements for opening a business bank account vary by state, entity type, and other factors. While some banks require a minimum opening deposit of $5 or $1,000, others allow no money down. The good news is that online banking is usually free, although there are a few exceptions. If you want to use Wells Fargo Business Online, sign up today.

Wells Fargo Mobile

If you’re having trouble accessing Wells Fargo Mobile, you may not have the latest iOS version. There are several ways to fix this issue, including restarting your device. If you can’t log in to Wells Fargo Mobile on your phone, you may also try reloading the page, which will usually fix the problem. If not, you may want to change your password. In any case, you must be sure to protect the security of your personal information.

Once you’ve completed the registration process, you can view your account information. You’ll need to enter your Social Security number or ATM/debit card number. You’ll also be required to confirm your email address. To do this, visit your wellsfargo.com/sign-in page. Look for the “Enter your user name” or “Reset password” link. Then, follow the directions on the screen.

If you’re still unable to log in using the app, try clearing the data and cache on your device. If that doesn’t work, try restarting your device. This will remove temporary files and free up RAM. Clear your data and cache before logging in again is also a good idea. After doing this, you should be able to log in to Wells Fargo Mobile successfully. You may want to contact Wells Fargo Customer Support if all else fails. They will be happy to assist you.

Mobile is a crucial channel for customers. Wells Fargo is working on a revamped mobile banking experience. The first phase of the redesigned public website should be introduced early in 2022. It’s also the fastest-growing channel in history. In Q3 2021, Wells Fargo customers used mobile devices to log in to their accounts, up 14% more than they did the year before.

It would be best to keep a few things in mind when using the mobile banking application. Once you’ve set up the mobile application, you’ll be able to access your account from anywhere. The application has a branch locator that lets you filter your search by location, availability, and service. Alternatively, you can visit the bank’s physical headquarters in San Francisco, CA. While the bank is open Monday to Friday, it is closed on federal holidays.

Turning off your card is an option. This is not a substitute for reporting lost or stolen cards. It will not stop recurring transactions, refunds, or credit adjustments. This method will also turn off any digital card numbers linked to your account. You must also be aware that turning off your debit card will turn off all the cards linked to your deposit or credit card account. If you use this option, the mobile carrier may charge you for message and data rates.