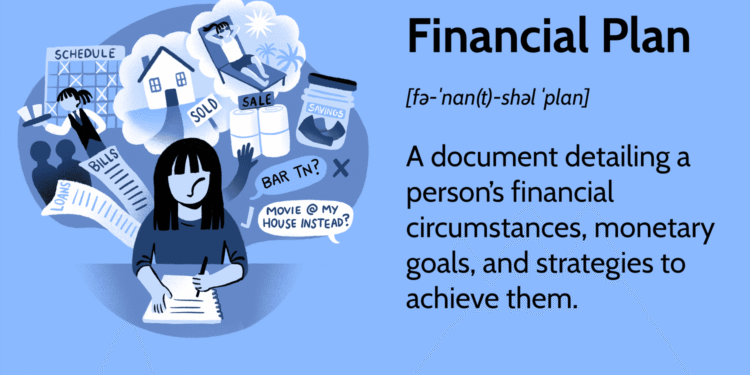

In today’s rapidly changing financial landscape, mastering the essential financial planning skills has become more than just a luxury – it’s a necessity. Whether you’re striving to achieve long-term wealth, ensuring financial security for your family, or simply looking to manage your day-to-day finances effectively, financial planning skills can help you make smarter choices, avoid unnecessary financial stress, and ultimately achieve your goals. But what exactly do financial planning skills ultimately enable an individual to do? This article will delve into how these skills empower individuals to take control of their financial future, optimize their resources, and make more informed decisions in every aspect of their financial lives.

1. Building a Strong Foundation for Financial Security

At the core of financial planning lies the ability to build a secure foundation for the future. One of the primary benefits of mastering financial planning skills is the ability to create financial stability that will last. This stability comes in the form of a solid financial base, which includes creating emergency funds, managing debt, and ensuring long-term security.

Creating Emergency Funds

The first step in achieving financial security is establishing an emergency fund. Financial planning skills allow individuals to set aside a portion of their income to cover unexpected expenses such as medical bills, home repairs, or job loss. This safety net helps prevent the need to rely on high-interest loans or credit cards in times of crisis, protecting both short-term and long-term financial health.

Managing Debt Effectively

Debt is one of the most significant financial challenges that many people face, and how you manage it can make all the difference in your financial future. Effective financial planning teaches individuals how to prioritize and eliminate high-interest debt, avoid unnecessary borrowing, and create a strategy for becoming debt-free. A structured approach to debt repayment can lead to improved credit scores and more disposable income in the long run.

Achieving Long-Term Stability

Building wealth doesn’t happen overnight. Through financial planning, individuals can make consistent contributions to long-term savings, such as retirement accounts, that ensure financial security in their later years. By calculating future needs and adjusting savings strategies accordingly, individuals set themselves up for a secure, stress-free future.

2. Achieving Financial Goals with Clarity and Precision

One of the most powerful aspects of financial planning is its ability to provide individuals with the tools they need to set and achieve specific financial goals. Without a clear roadmap, it’s easy to lose focus or veer off course. Financial planning skills allow individuals to break down their long-term aspirations into actionable, measurable steps.

Setting Realistic Financial Goals

When you know how to set financial goals, you give yourself something to strive toward. Financial planning helps individuals assess their current financial situation and determine what they want to achieve in both the short-term (such as paying off debt or buying a car) and long-term (like saving for a home or retirement). Financial planners often recommend using SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) criteria to ensure goals are well-defined and attainable.

Tracking and Adjusting Progress

Once goals are set, financial planning skills enable individuals to track their progress regularly and make adjustments as needed. By creating a budget and reviewing expenses, it becomes easier to stay on track and make changes if you’re veering off course. Whether it’s reducing discretionary spending, increasing savings, or adjusting investments, having a financial plan provides clarity on what needs to be done to meet your goals.

Optimizing Investments for Growth

Investing is a crucial part of growing wealth, and financial planning allows individuals to choose investment opportunities aligned with their goals and risk tolerance. Whether investing in stocks, bonds, or real estate, financial planning helps individuals maximize their returns and ensure that their investments are contributing to their overall financial success.

3. Enhancing Quality of Life and Personal Well-being

A key benefit of financial planning is that it directly contributes to an individual’s overall well-being and quality of life. When financial worries are alleviated through sound planning, stress levels decrease, allowing for more focus on personal goals, family, and health.

Reducing Financial Stress

When you have a financial plan in place, you no longer have to constantly worry about money. Knowing that you have a safety net, that you’re on track to meet your goals, and that you’re building wealth for the future offers peace of mind. By eliminating uncertainty, financial planning helps reduce stress and promotes a healthier, more balanced lifestyle.

Empowering Family Planning

Financial planning isn’t just about one person—it’s about ensuring your family’s future as well. From saving for children’s education to planning for healthcare needs, financial planning allows individuals to allocate resources for the well-being of their loved ones. Additionally, with a financial plan in place, parents can set up life insurance policies or estate plans to protect their family members in case of an unforeseen event.

Achieving Life Milestones

Whether it’s buying a home, paying for a wedding, or saving for a child’s college fund, financial planning ensures that you’re financially ready for major life milestones. These milestones often require careful preparation, and by incorporating them into your financial strategy, you can achieve these milestones without derailing your long-term goals.

4. Building Wealth and Achieving Financial Growth

Financial planning skills aren’t just about managing expenses—they’re also about accumulating wealth and growing your financial portfolio over time. With the right financial strategy, individuals can achieve their financial aspirations and increase their net worth.

Asset Accumulation

Financial planning enables individuals to actively work toward acquiring valuable assets, such as real estate, stocks, and businesses. These assets serve as the building blocks of wealth, and with the proper planning, they can provide passive income and long-term financial growth. Having a clear plan allows individuals to allocate funds toward asset accumulation in a disciplined and strategic manner.

Diversifying Investment Portfolio

One of the most important elements of wealth-building is diversification. A well-rounded investment portfolio spreads risk across different asset classes, reducing the potential for significant financial loss. Financial planning skills help individuals determine the optimal mix of investments based on their goals, risk tolerance, and time horizon.

Maximizing Tax Efficiency

Another benefit of financial planning is the ability to manage tax liabilities effectively. Financial planners often guide individuals on how to invest in tax-deferred accounts (such as IRAs and 401(k)s) or tax-advantaged investment options to reduce the tax burden. This helps individuals retain more of their earnings and invest them back into their wealth-building efforts.

5. Preparing for a Comfortable Retirement

Retirement might seem far off for some, but starting early with financial planning is the key to ensuring a comfortable and stress-free retirement. Financial planning provides individuals with a roadmap for saving, investing, and generating income in their post-work years.

Retirement Savings Optimization

One of the first steps in preparing for retirement is contributing to a retirement savings account. Financial planning skills help individuals choose the right retirement plans, such as a 401(k), IRA, or Roth IRA, and decide how much to contribute based on their retirement goals. Through consistent saving and smart investing, retirement planning provides peace of mind knowing that future needs will be met.

Calculating Future Retirement Needs

Financial planning also allows individuals to estimate how much money they will need during retirement and how long their savings will last. This involves considering factors such as inflation, medical expenses, and desired lifestyle. With this information, individuals can adjust their saving and investing strategies accordingly to ensure they’ll have enough for a comfortable retirement.

6. Navigating Major Life Changes with Confidence

Life is unpredictable, and financial planning helps individuals adapt to significant life changes with confidence and stability.

Handling Career Transitions

Job changes, career pivots, or periods of unemployment can be financially challenging. However, financial planning skills allow individuals to build up resources that will help them navigate these transitions with less financial strain. Having a financial cushion and a clear budget for career transitions can prevent you from falling into financial difficulty.

Coping with Divorce or Separation

Divorce or separation can be a financially overwhelming experience, especially when it comes to dividing assets and managing new living expenses. Financial planning helps individuals prepare for these significant life changes by outlining how to manage finances in a way that ensures a secure future post-divorce.

7. Conclusion: The Empowerment of Financial Planning Skills

In conclusion, mastering financial planning skills ultimately empowers individuals to take control of their financial destiny. By setting clear goals, managing debt, building wealth, and planning for the future, individuals gain the tools necessary to achieve financial independence and peace of mind. These skills not only help individuals secure their future but also provide them with the confidence to make informed decisions at every stage of life. Whether you are starting your financial journey or looking to refine your strategy, it’s never too late to take control of your financial future and begin reaping the benefits of financial planning.

Do Read: Malia Manocherian – A Journey Through Real Estate, Philanthropy, and Social Impact